The world has moved from gold coins to paper money. These currencies are government-backed, and most of them can be traded digitally. The fiat currencies are mutually exchangeable with a standard variable rate.

However, cryptocurrency is the digital asset of the modern world. Most countries do not have specific rules on the taxation of these assets. No matter, their popularity has increased enormously since the birth of Bitcoin in 2009.

Paying taxes is a tough job. We can’t keep records of every single transaction. Hence, people use software for filling tax return forms.

Cryptocurrencies are more complicated. It is difficult to track, report, and file for cryptocurrency assets. To understand the benefits of online crypto tax software, first, it is necessary to get an understanding of cryptocurrency.

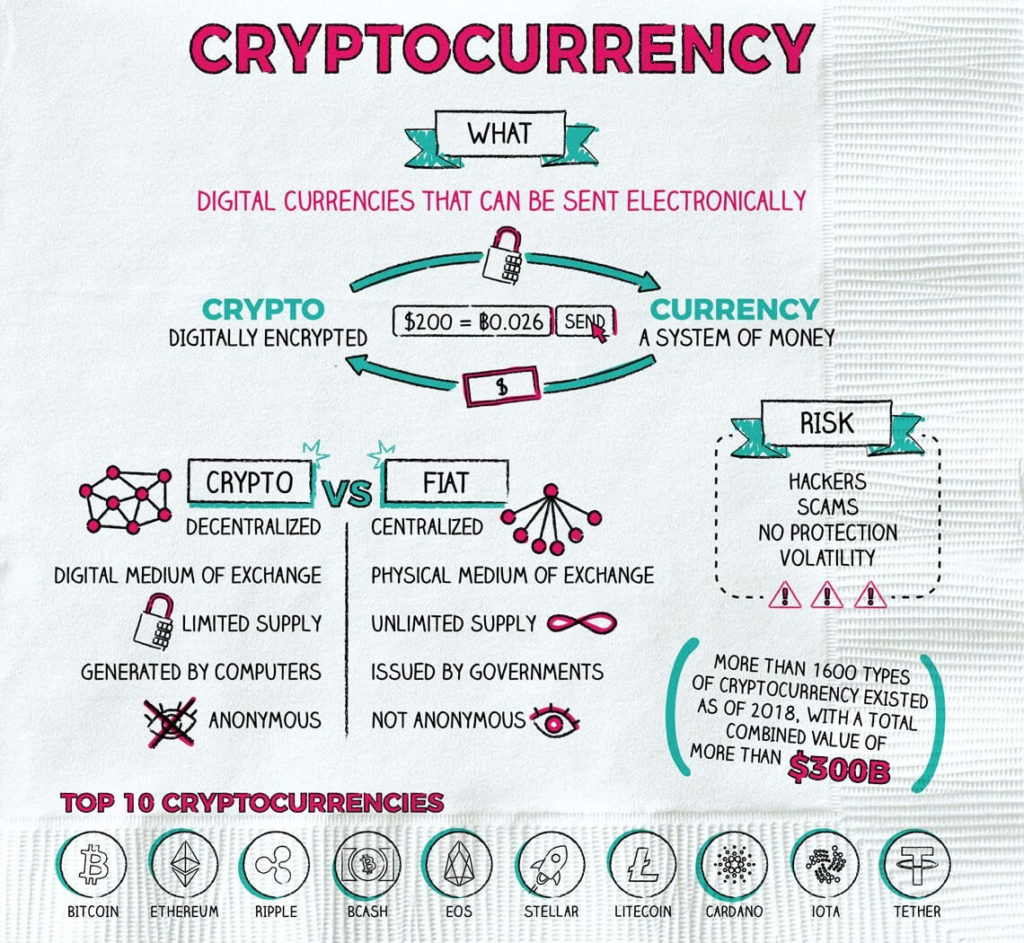

What Is Cryptocurrency?

Cryptocurrency is a secure digital currency. It is backed up, created, and maintained using enhanced encryption techniques known as cryptography. They use the public and private keys for encryption.

A cryptocurrency is a decentralized form of digital currency, relying on shared access over multiple devices. Hence, it can independently issue currency, process, and verify transactions. Cryptocurrencies allow easy conversion and exchange of currencies.

Central banks regulate Fiat currency. They can always print money and increase the amount in circulation. Bitcoins, on the other hand, depend on the amount an investor is willing to pay for them.

High-powered computers use a distributed network to mine Bitcoin. Mining is the process of creation and accumulation of Bitcoin. However, it takes a long time.

Cryptocurrency Taxation

Cryptocurrencies are not managed or ruled by any central bank or government. Thus, the IRS considers cryptocurrencies as property. Hence, property tax rules apply to cryptocurrency.

When Is Cryptocurrency Taxable?

Crypto tax rules state that selling, holding, mining, or trading cryptocurrency is subject to taxation. Moreover, owning foreign cryptocurrencies above $10,000 are also subject to taxation. Buying cryptocurrency except by using USD is also taxable.

When Is A Cryptocurrency Not Taxable?

Cryptocurrencies are non-taxable while gifting, donating, and transferring between accounts and wallets. Owning foreign cryptocurrencies under $10,000 are non-taxable under FBAR rules. Using USD to purchase cryptocurrencies is free from taxation.

The Tax Calculation For Cryptocurrencies

According to the IRS, we need to treat cryptocurrencies as assets. Hence, they have long term and short term capital gains. The bitcoin tax rate may vary under these conditions.

Short Term Capital Gains

If you hold bitcoins for less than one year before selling or using them, it will be considered as short term capital gain. You will have to pay taxes under the normal tax bracket.

Long Term Capital Gains

If you hold bitcoins for over one year, the profit you accumulate will be taxable under long terms capital gains. In this scheme, the tax rate for Bitcoin varies from 0% to 20%, depending on income.

For income under $78750, there is 0% tax. There is a 15% tax rate for income within $78750 to $434500. Any income higher than that will be taxable at the rate of 20%.

Filing Crypto Taxes Effectively

You need to fill up the Schedule D and Form 8949 for cryptocurrency taxes, after calculating the profit from the exchange rate at the date and time of the transactions. Form 8949 deals with the sale and disposition of capital assets like Bitcoin. Schedule D deals with taxes incumbent from capital gains and losses.

Benefits of Using Software to File Cryptocurrency Taxes

You can try to painstakingly find every single transaction from your records, calculate, and file returns. Even after putting all the effort, you might still need to send an amended form. It is wise to look for free crypto tax software that can allow you to stay free from the hassles of filing cryptocurrency tax return forms.

A few benefits of using crypto tax software are listed below:

1. Accessibility and Storage

With the advent of the internet, cryptocurrencies like Bitcoin have welcomed online crypto tax software with open arms. It has become easier than ever to file for taxes with an easier file system directory that you can access at any time to track real-time taxation. You can also access files from previous years that can help with added tax benefits.

Since you can easily track the activity online, you don’t need to have your pen and paper at all times to record every minute detail. It also helps to track personal transfer between wallets and also supports most of the exchanges, including fiat currency and cryptocurrencies. It allows them to separate foreign cryptocurrencies as well.

2. Ease of Calculation

Calculating taxes using old methods and dividing different assets based on their type of calculation is complicated. For example, long term taxes are different from short term taxes. For starters, it is difficult to even separate taxable and non-taxable assets.

Let us use an example to understand the basic tax calculation. Suppose you buy 2 Bitcoins for $736 each and sell both of them at $1000 each. The amount of taxable income is 2*($1000-$736), which is equal to $528.

The order in which you sell the coins changes the tax rate. According to tax regulations, we can either use FIFO or LIFO and must be consistent with it. So, we can have holdings of different durations, which makes the tax calculation complicated.

For short term gains, the tax rate will be under a different tax bracket from the long term gains. Moreover, trading between different currencies and cryptocurrencies makes tax calculation more difficult.

3. Form Filling and Auditing

Online cryptocurrencies tax software is tax compliant with Turbotax integration. They can easily download necessary forms and fill up the fields from their data without making any mistakes.

Moreover, they can also account for capital losses, which can be adjusted from previous years to make amends with capital gains in the corresponding years. Hence, the audits and records help you save on taxes.

4. Informative

A lot of these softwares also have blogs and informative content. Reading these will help you get more knowledge about the different things in the cryptocurrency industry.

5. Additional Benefits

Sometimes, you may want to invest in new cryptocurrencies using the Initial coin offering. You get tokens of the new cryptocurrency, which has no real value.

When the new cryptocurrency launches for the public on the main net from the test net, online crypto software can help you convert the tokens into crypto coins. Converting them by yourself requires technical knowledge about blockchain and cryptocurrency, which everyone may not have.

Hence, it is time to ditch the old methods, and progress to the modern age with online crypto tax softwares.